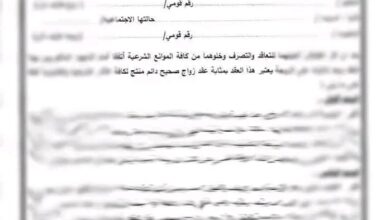

كتابة عقود زواج عرفي

منذ أسبوع واحد

هل تريد التواصل مع محامي زواج عرفي ؟؟

هل تريد التواصل مع محامي زواج عرفي ؟؟ تواصل مع محامي زواج عرفي هل تبحث…

الدعم القانوني

14th مارس 2024

البراءه في قضايا التزوير

افضل محامي في قضايا للتزوير تعتبر من إحدى الأمور التي يبحث عنها الكثير من الناس…

محامي قضايا الاسره

14th مارس 2024

محامي قضايا الطلاق والخلع

أفضل محامي محكمة الأسرة هو رجل القانون المسئول عن تطبيق القواعد القانونية لقضايا الأحوال الشخصية،…

غير مصنف

1st مارس 2024

اشهر محامي ملكيه فكريه في مصر

اشهر محامي ملكيه فكريه في مصر الحماية الفكرية تعد أحد أفرع الملكية حيث لا تقتصر…

زواج الاجانب في مصر

14th فبراير 2024

اجراءات زواج الاجانب فى مصر2024

اجراءات زواج الاجانب فى مصر2024 الاوراق المطلوبة لكى يتم زواج الاجانب فى مصر 2024 هى من…

الدعم القانوني

9th فبراير 2024

كيف تثبت الدفع بمدنية النزاع فى ايصال الامانة وان المتهم حرر ايصال الامانة على بياض ؟

كيف تثبت الدفع بمدنية النزاع فى ايصال الامانة وان المتهم حرر ايصال الامانة على بياض…

الدعم القانوني

1st فبراير 2024

ما الفرق بين ترك الخصومة والتنازل عنها؟

ما الفرق بين ترك الخصومة والتنازل عنها؟ مادة ١٤١: يكون ترك الخصومة بإعلان من التارك…

محامي جنائي

31st يناير 2024

التفتيش فى القانون المصري 2024

التفتيش فى القانون المصري 2024 محل التفتيش كأجراء يمس الحياة الخاصة للمتهم بوصفه إنسانا له…

الدعم القانوني

12th يناير 2024

عبد المجيد جابر المحامي بالنقض يعلن عزمه الترشح لعضوية مجلس نقابة المحامين على مقعد استئناف القاهرة

عبد المجيد جابر المتحدث الرسمي بأسم حملة ادعم نقابتك يعلن عزمه الترشح لعضوية مجلس نقابة…

استشارات قانونيه

7th يناير 2024

ما هي اجراءات تنفيذ الاحكام في مصر2024

ما هي اجراءات تنفيذ الاحكام في مصر2024 ماهى الحالات يجوز فيها تنفيذ الأحكام الصادرة من…